Federal Geothermal Tax Credits

The Internal Revenue Service has published how the Federal Geothermal Tax Credits will change after 2026.

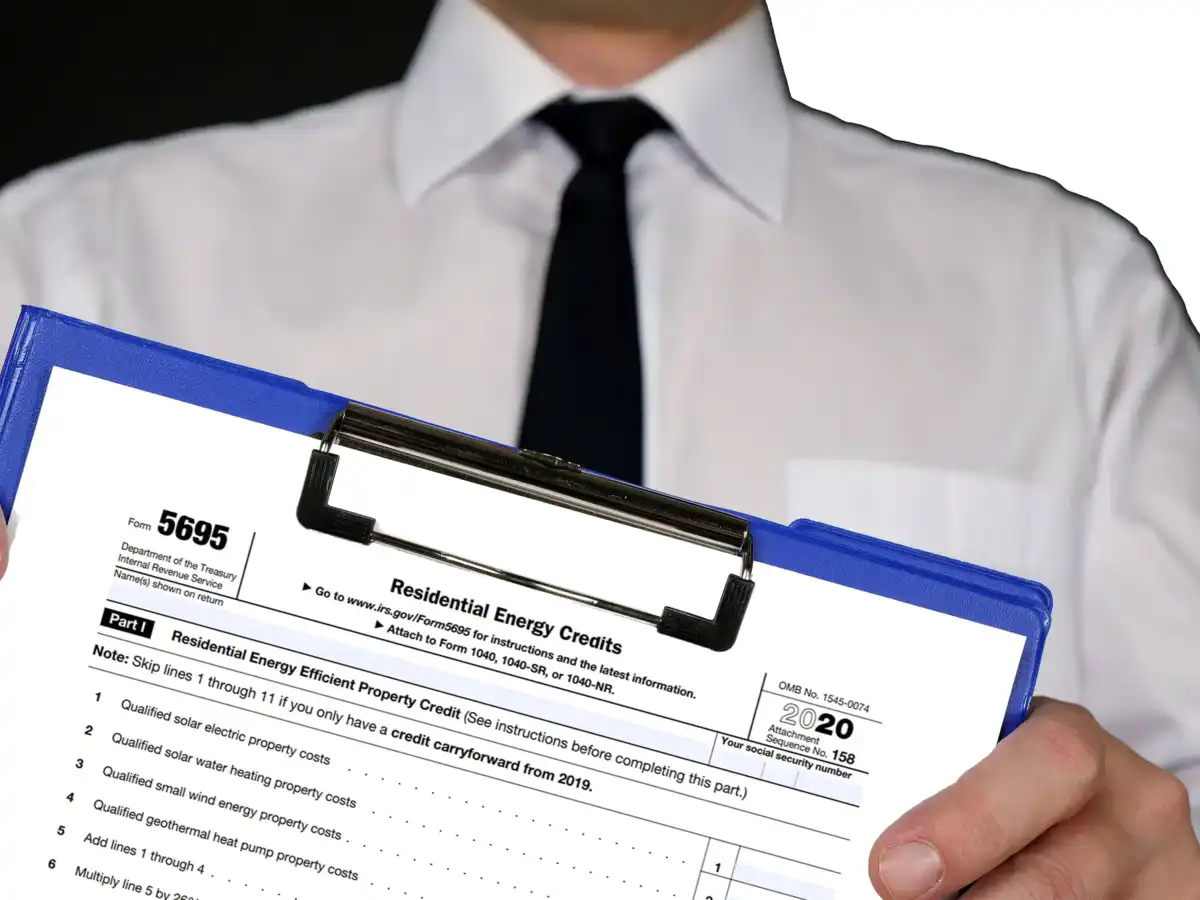

Q. Are there incentives for making your home energy efficient by installing alternative energy equipment? (updated April 27, 2021)

A. Yes,

- The residential energy efficient property credit allows for a credit equal to the applicable percent of the cost of qualified property.

- Qualifying properties are solar electric property, solar water heaters, geothermal heat pumps, small wind turbines, fuel cell property, and, starting December 31, 2020, qualified biomass fuel property expenditures paid or incurred in taxable years beginning after that date.

- Only fuel cell property is subject to a limitation, which is $500 with respect to each half kilowatt of capacity of the qualified fuel cell property.

- Generally, this credit for alternative energy equipment terminates for property placed in service after December 31, 2023. The applicable percentages are:

-

- In the case of property placed in service after December 31, 2019, and before January 1, 2023, 26%

- In the case of property placed in service after December 31, 2022, and before January 1, 2024, 22%

Filling out the IRS Form 5695 is not difficult. The form is located here: IRS Form 5695 Instructions

Form Instructions for the IRS are located here: Federal Geothermal Tax Credits Instructions

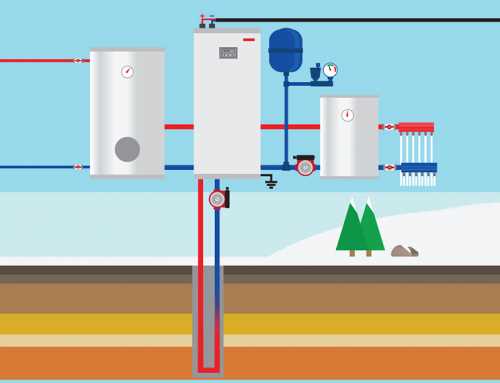

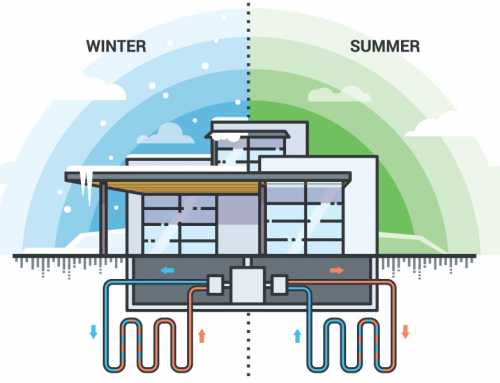

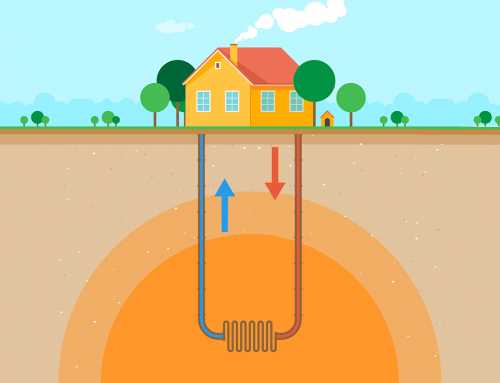

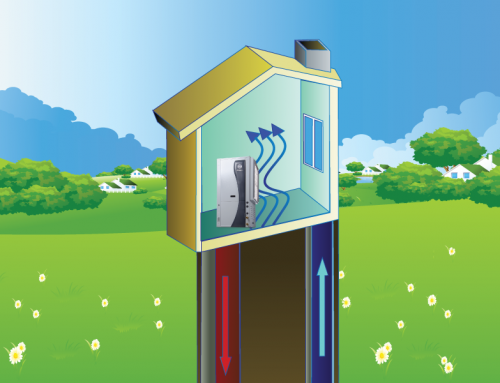

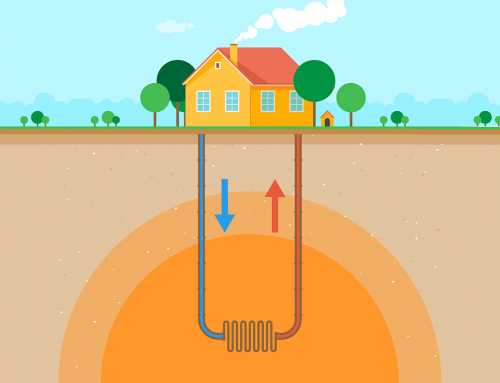

Qualified geothermal heat pump property costs. Qualified geothermal heat pump property costs are costs for qualified geothermal heat pump property installed on or in connection with your home located in the United States. Qualified geothermal heat pump property is any equipment that uses the ground or ground water as a thermal energy source to heat your home or as a thermal energy sink to cool your home. To qualify for the credit, the geothermal heat pump property must meet the requirements of the Energy Star program that are in effect at the time of purchase. The home doesn’t have to be your main home.