The battle to reinstate federal tax credits to geothermal systems has been long standing. The geothermal business has been working enthusiastically to amend the lapsed 30 percent private and 10 percent commercial federal tax for geothermal heat pumps, since the 31st of December, 2016.

The battle to reinstate federal tax credits to geothermal systems has been long standing. The geothermal business has been working enthusiastically to amend the lapsed 30 percent private and 10 percent commercial federal tax for geothermal heat pumps, since the 31st of December, 2016.

While credits for solar and wind were extended, the congressional oversight to restore the geothermal expense credits to take equality among sustainable power source advances was put to the forefront. Banding together with other orphaned technologies, geothermal systems got left behind in the augmentation of the newly instated tax credit system.

The attempt to incorporate the deserted ‘orphaned technologies’ included expanding the solar and wind taxation systems in 2016. “Through codes in Segment 48, which is business, and 25D, which is private,” Dougherty said. “We shaped a coalition with the other stranded advances, which incorporate joined heat and power, fuel cell, and wind energy alongside geothermal pumps. In an attempt to further promote the local business and their technological development the government is primarily focusing on giving opportunities to geothermal systems created within the borders.”

“All of the geothermal heat pumps installed here are made in the U.S.”- Doug Dougherty – GEO

Doug Dougherty says there are two other energy issues that they think can be joined with their endeavors that would get a ton of bipartisan help. The issues being – the Nuclear issue on a production tax credit which conjugates two nuclear control plants in South Carolina and Georgia, and the other is to change the tax code for carbon dioxide sequestration. Joining these three bills would accumulate support for the government which would further aid the trifecta to work in support of getting their credits restored.

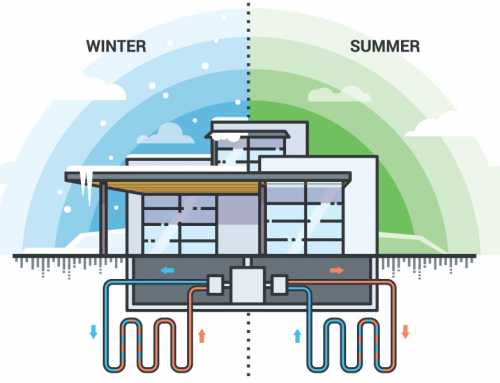

The tax credit termination has created a major disruption in the sales of geothermal power units. Numerous dealers who also trade in solar panels have been promoting solar powered systems over HVACs due to the newly implied tax credit systems. Essentially solar-powered units are developed and manufactured in China, importing goods to the US internationally. This means that a major part of the tax break is heading straight out to international waters rather than benefiting the local companies.

With sales of HVACs dropping lower than 40%, companies such as Enertech have had to lay off more than 27 employees (on public record) due to the pitfall in the credit system.

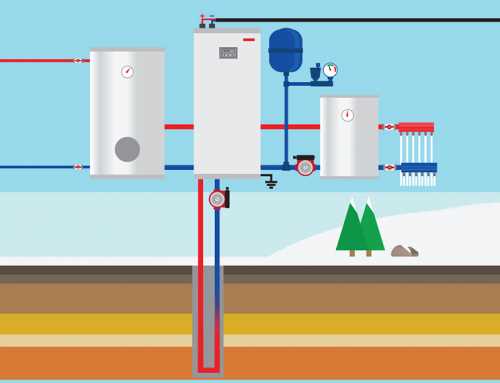

Most of the geothermal heat pump units in the nation are indigenously manufactured, and that includes all the parts that go into it.

The primary concern remains that the Congress has made a duty application disparity that isn’t right, and they’ve promised to settle it. While the Congress have sat tight a year and a half for them to settle it, the ray of hope is starting to seem bleaker as there has been no significant change or urgency to do so, going by the recent past.