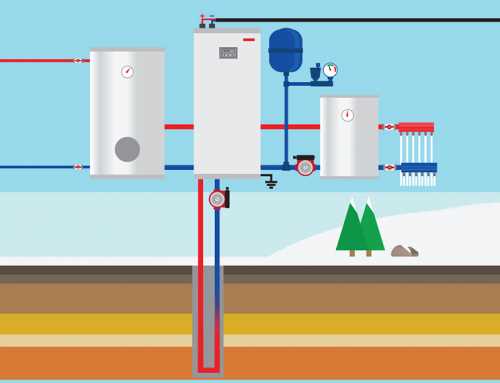

The U.S geothermal industry saw the light of a shiny future with a solid victory for their employees, seeing a revision in the federal tax credits for its commercial and residential installations. The inequality created two years ago had created significant distress in the market, but the Congress’ current decision to reinstate geothermal tax credits have been a game changer that safeguard the industry’s future as a whole, all the way up to 2021.

GEO Members and coalition partners including the National Rural Electric Cooperative Association, the Association of Homebuilders, the Hydrogen and Fuel Cell Association and the American Gas Association, lobbied relentlessly in Washington since early 2017, to reinstate and extend 30% federal tax credits for residential geothermal heat pump (GHP) installations, and 10% credits for commercial jobs.The battle over the last couple of years had been an uphill one, and legislators working tirelessly finally breathe a sigh of relief when the new bill passed listed out how all commercial projects would be listed under the tax credit system of the of commencement rather than the year it would be put into service. This not only works in the favor of the industry but on a global scale, reinstating the use and promoting the ecological benefit of using geothermal systems extensively.

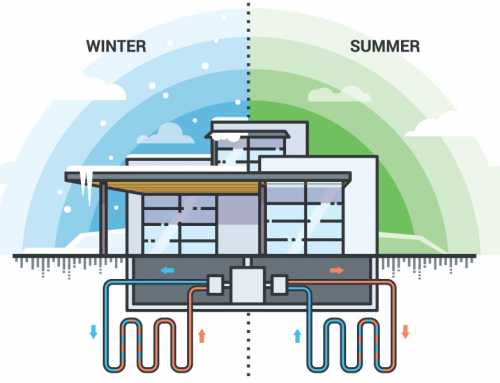

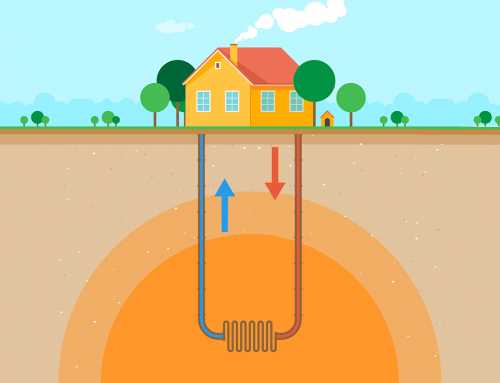

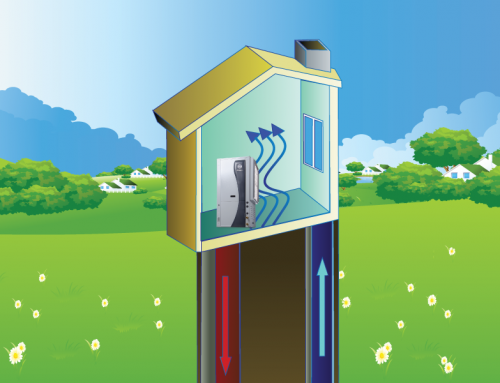

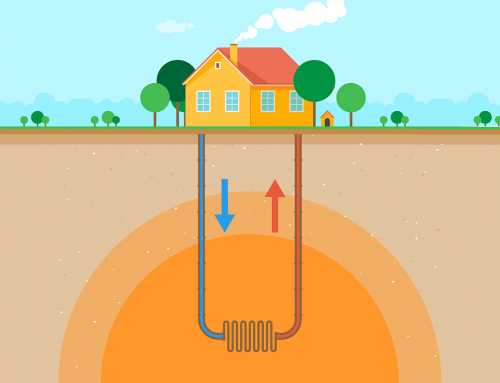

The installations of geothermal systems over the predominantly using heating and cooling systems would reduce the carbon footprint significantly, saving in return tens of thousands of dollars wasted unnecessarily.Doug Dougherty, President and CEO of Geothermal Exchange Organization (GEO) stated “Credits for technologies including GHPs, fuels cells, micro-turbines, small wind and combined heat and power were left to expire at the end of 2016. Today’s action by Congress finally fixes the inequity created two years ago when tax credits for solar installations were extended through 2021,”The credit system talks of tax brackets of 30 percent if the system is installed between 2017 and 2019, then lowers to 26 percent in 2020 and further down to 22 percent through 2021.

Relentless work and campaigns throughout the geothermal industry have led them to achieving this critical milestone that wouldn’t be achieved otherwise. Promoting employment, the revision of tax credits will also be beneficial in breaking down numerous market barriers and achieve economic diversity that would lead to growth and prosperity all over America.“Our hard-fought victory for the GHP industry helps ensure a bright future for our technology,” said Dougherty. With the promise of a bright future ahead, the new taxation system and the revolutionary technology of geothermal systems are all set to bring in a change, so big and so widespread that will change the way the world looks at renewable energy and the miracles created by it.